Bitcoin (BTC) has risen 10% this week as several groups of wallet holders switch from distribution to accumulation for the first time since August. The largest cryptocurrency rose above $121,000 on Thursday, the highest since it hit a record on Aug. 14, CoinDesk data shows.

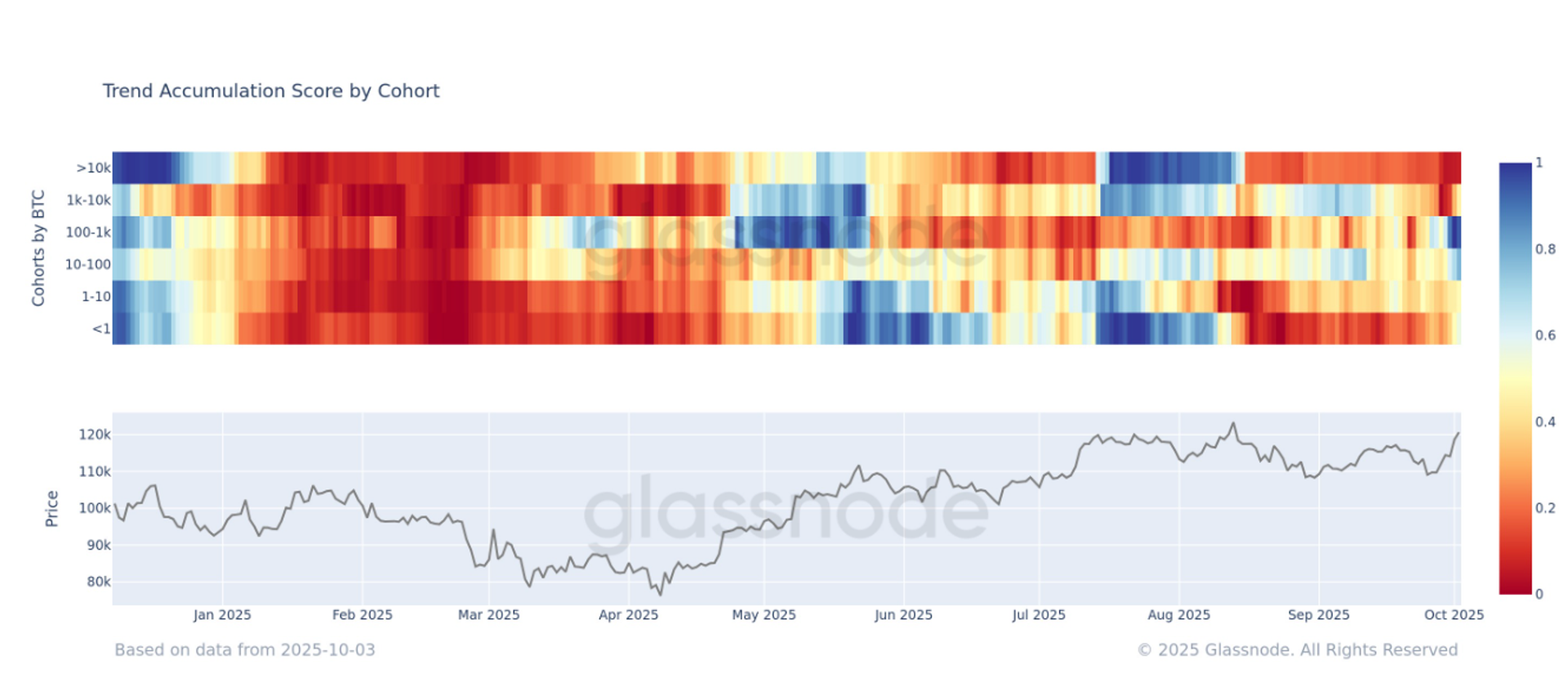

The Accumulation Trend Score, which measures the relative strength of accumulation or distribution over a 15-day period, has increased to 0.62, according to Glassnode data.

This value is above the neutral threshold of 0.5, signaling that on aggregate, market participants are looking to buy rather than sell. A reading closer to 1 indicates stronger accumulation, while a reading closer to 0 suggests distribution.

Broken down by cohort, wallets holding between 100 and 1,000 BTC have swung sharply into accumulation after distributing coins just last week. Those holding between 10 and 100 BTC are also beginning to accumulate again. Retail participants, who hold less than 10 BTC, have considerably slowed their selling and are beginning to show signs of buying activity.

On the other hand, large whales with balances above 10,000 BTC remain heavily into distribution, extending a trend that has persisted since August.

Alongside these shifts in wallet behavior, a notable bullish trading pattern has emerged in U.S. markets. From Monday through Thursday, bitcoin has consistently gained during U.S. trading hours, rising about 8% during these sessions alone, according to Velo data.

Discover more from Stayupdated.co.uk

Subscribe to get the latest posts sent to your email.